Im not sure if its sad or funny when the public realise insiders are dumping

- https://twitter.com/DereckCoatney/status/1383440872679739394

Sunday, April 18, 2021

$COIN

Sunday, January 17, 2021

Its all swiss cheese, anyone telling you otherwise is lying or wrong

Great article.

https://www.bloomberg.com/news/articles/2020-12-24/solarwinds-hack-is-the-latest-to-affirm-our-data-nihilism

Needed more in-depth details but the line "sure go ahead and mix a few special characters into your password if it makes you feel better" is pure gold and deserves a Pulitzer for this alone.

Friday, January 1, 2021

New Year....new problems

2021 cant get any worse than 2020.....or can it

:)

https://www.ft.com/content/edf87d72-8ef5-45fc-bbf5-ff84c322d396

https://www.ft.com/content/8ed73acb-1aa4-4a98-875a-a372ba960cda

https://www.ft.com/content/d8e11cc6-a1cb-4050-bb3b-4289680ce734

May we live in interesting times as the saying goes.

Monday, December 14, 2020

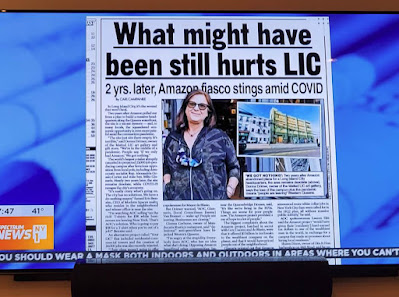

Amazon HQ2 ..... 2 years later

Just heard on @NY1 that 2 years later ....the Amazon HQ2 development site is still an empty abandoned lot.

Good thing @AOC blocked it ....would be a real shame if we had high level white collar tax paying jobs in Queens.

Saturday, September 19, 2020

History that pervades for decades

Really interesting article in the WSJ today

- https://www.wsj.com/articles/if-then-review-big-datas-baby-steps-11600439888?fbclid=IwAR2bkBhszL7bQmrz5P0ZfGaTOtmZM8jVVkxXapxYbfGE_WvXrG7q2gB1lrc

I love the idea of "forgotten knowledge' eg an entire industry does something in a certain way or format.....and no one knows the history of why or that they stand on the shoulders of giants.

Saturday, January 4, 2020

Monday, August 12, 2019

Vector Launch

- http://www.tucsonsentinel.com/local/report/081019_vector_launch/failure-launch-vector-ousts-tucson-ceo-rocket-firm-locks-out-employees